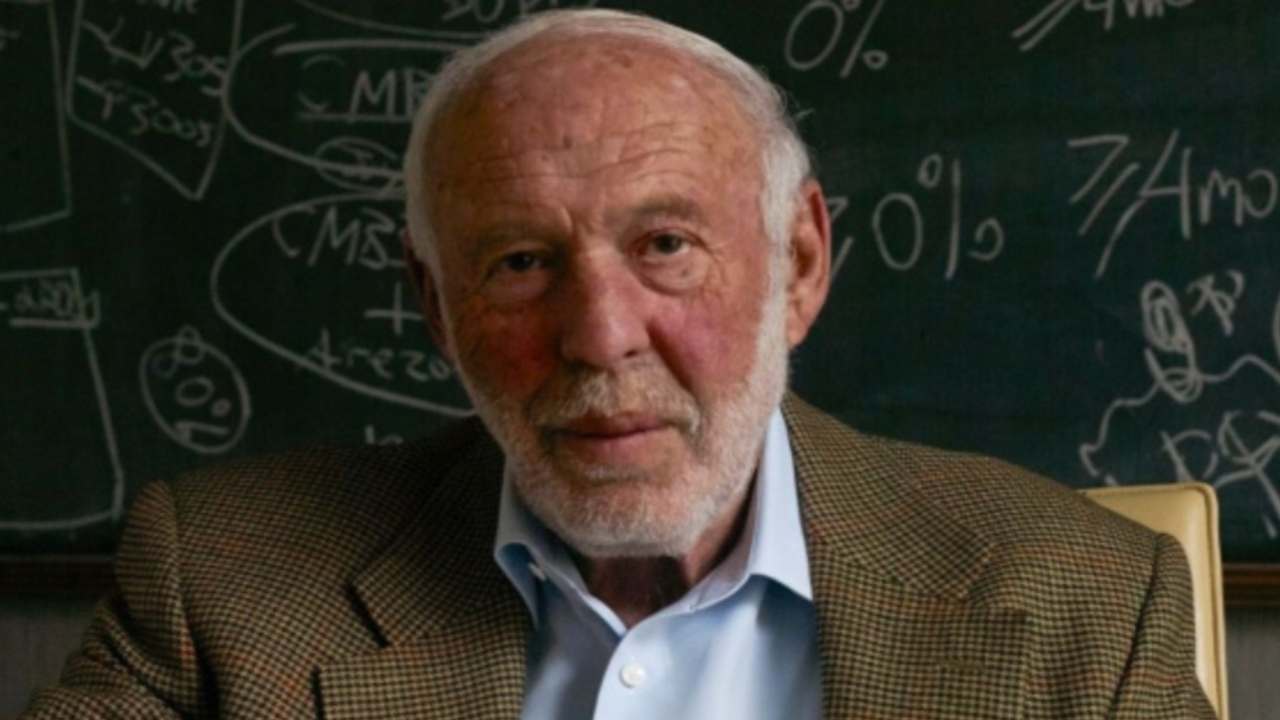

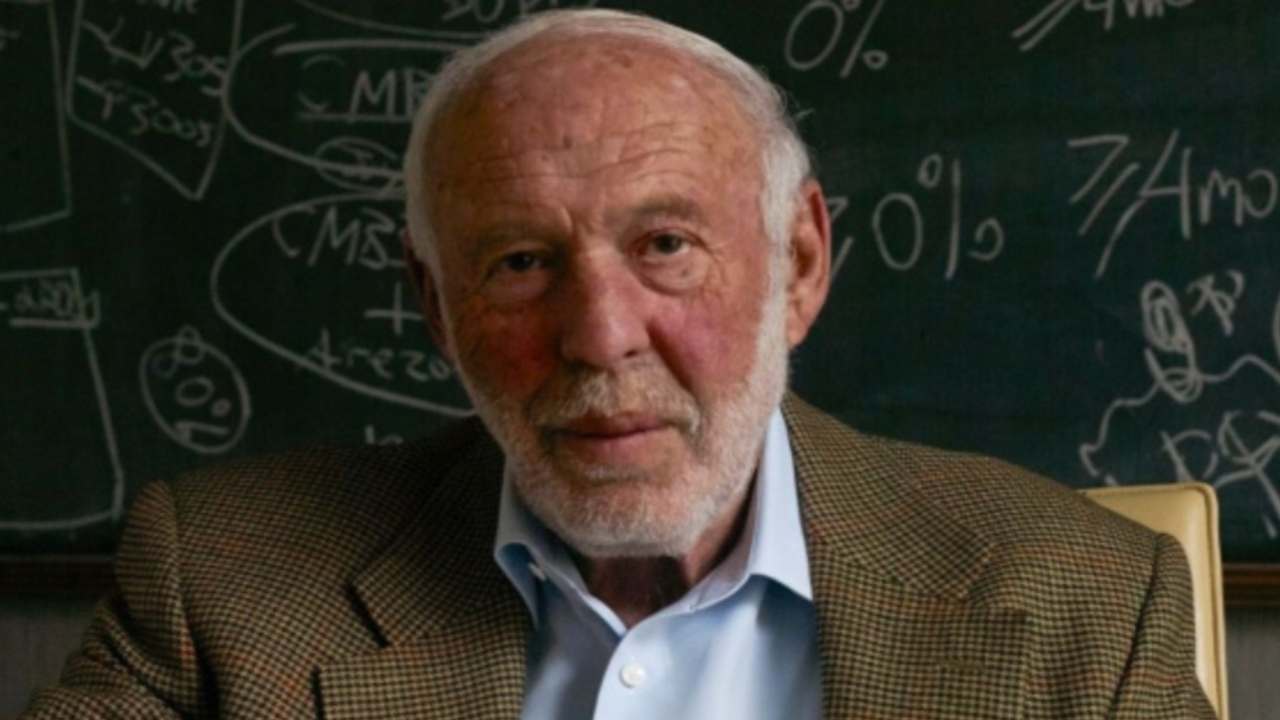

In response to the Simons Basis, Jim Simons, the billionaire investor, mathematician, and philanthropist, handed away in New York Metropolis on the age of 86.

Because the founding father of Renaissance Applied sciences, he performed a pivotal position in advancing quantitative investing, using mathematical and statistical fashions to discern funding alternatives.

Later in life, he additionally made important contributions as a political donor and philanthropist.

From an early age, Simons exhibited a profound love for arithmetic and numbers, as highlighted on his basis’s web site.

Born in Newton, Massachusetts, in 1938, he pursued a arithmetic diploma on the Massachusetts Institute of Expertise earlier than acquiring a doctorate in math from the College of California, Berkeley.

“Arithmetic was the one topic I favored,” Simons stated in a 2015 interview for the Numberphile podcast.

Following his educating roles at MIT and Harvard College, Simons transitioned to the Institute for Protection Analyses in Princeton, New Jersey, the place he contributed as a code breaker for the Nationwide Safety Company.

As documented by his basis, Simons confronted dismissal from the institute in 1968 on account of his vocal opposition to the Vietnam Battle.

Subsequently, he assumed a management place at Stony Brook College, serving as the top of the arithmetic division.

Exiting academia within the late ’70s, Simons ventured into the monetary realm, in the end establishing Renaissance Applied sciences in 1982.

“In wanting on the patterns of costs, I might see that there was one thing we might examine right here and that there have been methods to foretell costs mathematically and statistically,” Simons stated on the Numberphile podcast.

“Steadily, we constructed fashions, and the fashions acquired higher and higher. Lastly, the fashions changed the elemental stuff.”

Simons’ adept laptop fashions performed a pivotal position in increasing his hedge fund right into a multi-billion-dollar enterprise.

In his later years, Simons devoted himself to philanthropy, rising as a distinguished Democratic political donor.

The Simons Basis has been instrumental in supporting autism analysis and fostering science and math schooling and analysis via its grants.

Notably, the muse made headlines final yr with a monumental $500 million donation to Stony Brook College’s endowment, marking the most important unrestricted present ever bestowed upon an American college, as reported by the Simons Basis.

“I joined Stony Brook College in 1968 as chair of their Division of Arithmetic,” Simons stated on the time.

“I knew then it was a prime mental middle with a severe dedication to analysis and innovation. However Stony Brook additionally gave me an opportunity to steer — and so it has been deeply rewarding to look at the college develop and flourish much more.”