Inexperienced if true: Advances in know-how and reductions in the price of battery metals will quickly deliver electrical automobiles to cost parity with conventional automobiles, in accordance with Goldman Sachs. Nevertheless, this forecast overlooks present points with oversupply, environmental impression, and China’s export restrictions on rare-earth components.

Goldman Sachs is extremely optimistic about the way forward for electrical automobile batteries. The monetary large lately launched new analysis centered on EV batteries, predicting that battery costs will drop by almost 50 % throughout the subsequent few years. The know-how is advancing a lot sooner than initially anticipated.

The EV market is at the moment experiencing a part of obvious oversupply, which could appear to be dangerous information for battery tech. Nevertheless, Goldman Sachs Analysis is forecasting a resurgence in client demand that can “largely start” by 2026.

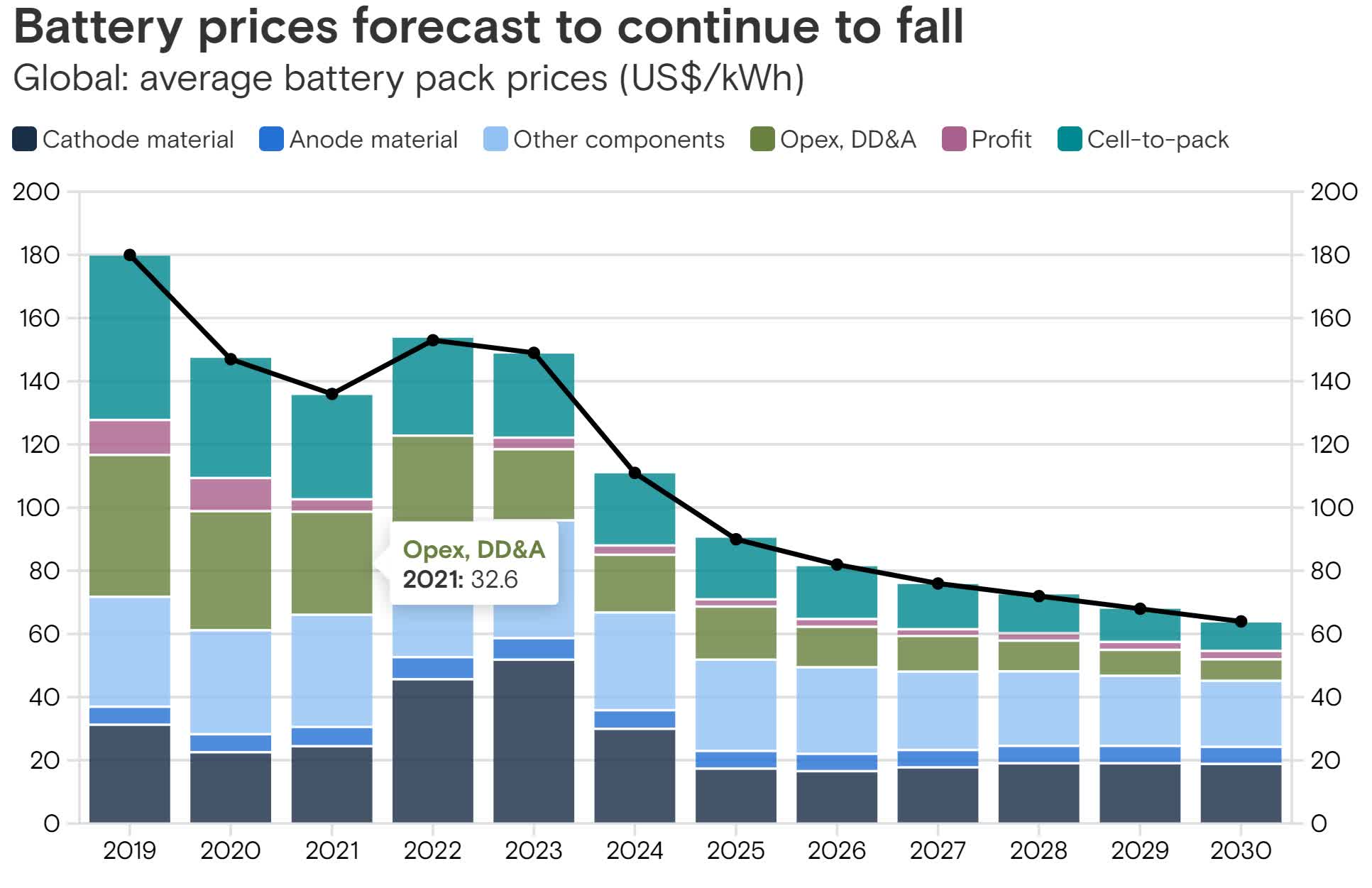

International common costs for EV batteries have already seen a decline, falling from $153 per kilowatt-hour (kWh) in 2020 to $149 in 2023. This yr, costs are anticipated to drop additional to $111 per kWh, and by 2026, they’re projected to succeed in simply $80. In two years, EV batteries will value almost 50 % lower than they did in 2023, bringing electrical automobiles to possession value parity with gasoline-powered automobiles within the US – and that is earlier than factoring in subsidies.

Nikhil Bhandari, co-head of Goldman Sachs’ Asia-Pacific Pure Assets and Clear Vitality Analysis arm, stated two key elements are driving the speedy decline in EV battery prices.

First, technological innovation is considerably rising power density. Many merchandise now function as much as 30 % larger power density at a decrease value, with a number of of those improvements already obtainable available on the market.

The second main issue is the “continued downturn in battery steel costs,” Bhandari famous. Important components like lithium and cobalt, which account for round 60 % of the price of EV batteries, have skilled value reductions. Between 2020 and 2023, the trade confronted substantial “inexperienced inflation,” with costs rising throughout the board for a lot of supplies.

In response to Bhandari, 40 % of the fee discount is attributed to decrease commodity costs. Nevertheless, he didn’t elaborate on how geopolitical tensions between the US and China may considerably disrupt market progress. China controls a number of the world’s largest deposits of uncommon earth components and is now utilizing its dominant place to push again towards export restrictions imposed by US authorities.

Goldman Sachs’ analysis additionally highlighted that lithium-based batteries will possible proceed to dominate the market, regardless of rising options like solid-state batteries providing doubtlessly revolutionary enhancements to the EV panorama. 5 firms at the moment management 80 % of the EV battery market, and their substantial R&D investments will possible keep excessive obstacles to entry for potential rivals.